By Max Rovegno

How Extreme Winter Conditions Affect Energy, Labor, Consumer Spending, and Local Economies

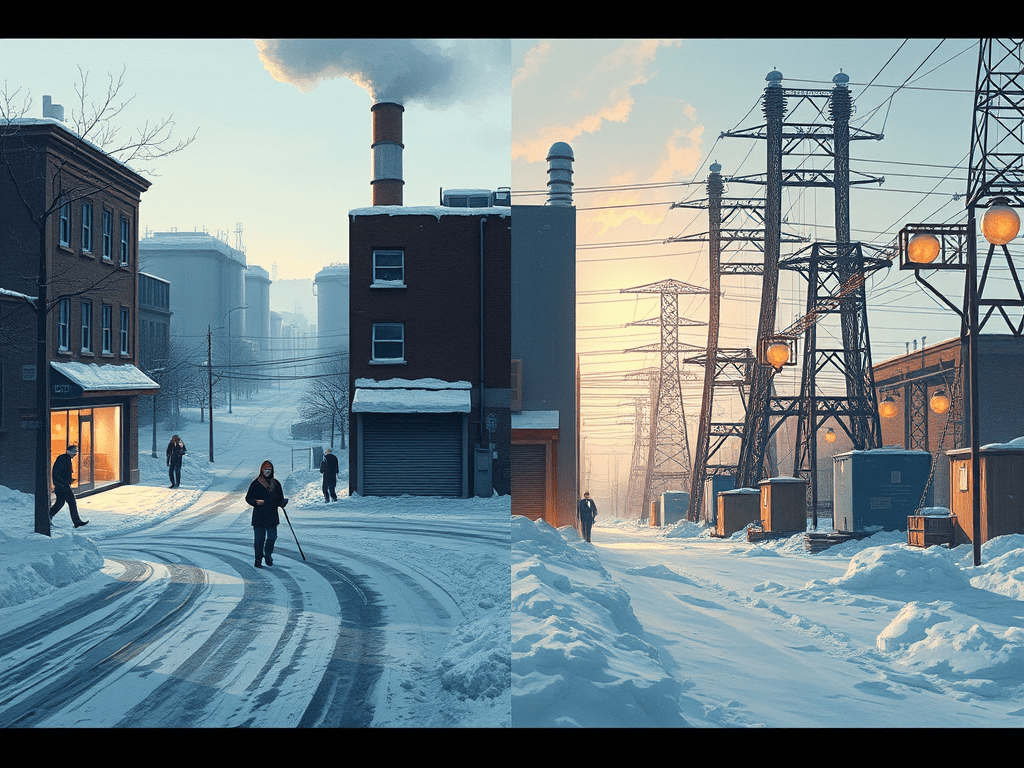

As severe cold weather sweeps across the country, its effects extend far beyond snow accumulation and freezing temperatures. Prolonged cold snaps have measurable economic impacts, influencing energy markets, labor productivity, consumer spending patterns, and government budgets. In many cases, the financial consequences of extreme winter weather linger long after temperatures begin to rise.

Increased Energy Demand and Rising Costs

One of the most immediate economic effects of extreme cold weather is a surge in energy demand. As households and businesses rely more heavily on heating systems, consumption of natural gas, electricity, and heating oil rises sharply. While energy providers may benefit from higher short‑term revenues, consumers often face elevated utility bills. For lower‑income households, prolonged cold spells can significantly strain monthly budgets, increasing overall financial stress.

Cold weather can also test aging energy infrastructure. When demand spikes too quickly, power outages become more likely, creating additional economic losses for businesses forced to close or operate at reduced capacity.

Transportation Disruptions and Supply Chain Impacts

Winter storms and extreme cold frequently disrupt transportation networks. Snow‑covered roads, icy bridges, and flight cancellations slow the movement of goods and people. These disruptions ripple through supply chains, affecting retailers, manufacturers, and food distributors. Delayed shipments can increase operating costs, lead to inventory shortages, and reduce sales — particularly for time‑sensitive industries.

Logistics companies often absorb higher expenses related to fuel, rerouting, equipment wear, and labor hours, costs that can eventually be passed on to consumers.

Labor Productivity and Employment Effects

Cold weather also impacts labor markets, especially in construction, transportation, agriculture, and outdoor services. Job sites may shut down temporarily, reducing worker hours and delaying projects. Businesses face productivity losses and scheduling challenges, while employees may experience lost wages during prolonged weather disruptions.

At the same time, certain industries see increased demand. Snow removal services, heating and HVAC providers, equipment repair companies, and emergency services often experience short‑term employment and revenue gains during extreme cold events.

Shifting Consumer Behavior and Public Spending

Consumer behavior changes dramatically during severe winter weather. Foot traffic to retail stores, restaurants, and entertainment venues typically declines as people stay home. Conversely, e‑commerce sales, grocery stocking, and home delivery services often see temporary surges.

Local and state governments also face higher operating costs, including road maintenance, snow removal, emergency response, and infrastructure repairs. Over time, repeated extreme cold events can influence public investment decisions and increase emphasis on weather‑resilient infrastructure.

Final Takeaway

While cold weather is temporary, its economic impact is not. From rising energy costs and disrupted supply chains to reduced labor productivity and higher government spending, extreme winter conditions expose the deep links between climate and economic stability. Understanding these dynamics helps businesses, households, and policymakers better prepare for the financial realities of winter.